Workshop Objectives

Property tax is an annual tax on real property. It is usually, but not always, a local tax. It is most commonly founded on the concept of market value. The tax base may be the land only, the land and buildings, or various permutations of these factors. For the purposes of this guide, property tax is restricted to annual taxes and excludes one-off taxes on transfers, on realized capital gains or betterment, or on annual wealth taxes. The strengths and weaknesses of this type of tax are well known and possibly more widely understood than any other tax. Under a property-tax system, the government requires or performs an appraisal of the monetary value of each property, and tax is assessed in proportion to that value.

This workshop will offer strategies for assisting in the effective formulation and implementation of tax policies and provides the context in which property tax policy is established. It is appropriate for accountants and others who wish to gain a working knowledge of property taxation.

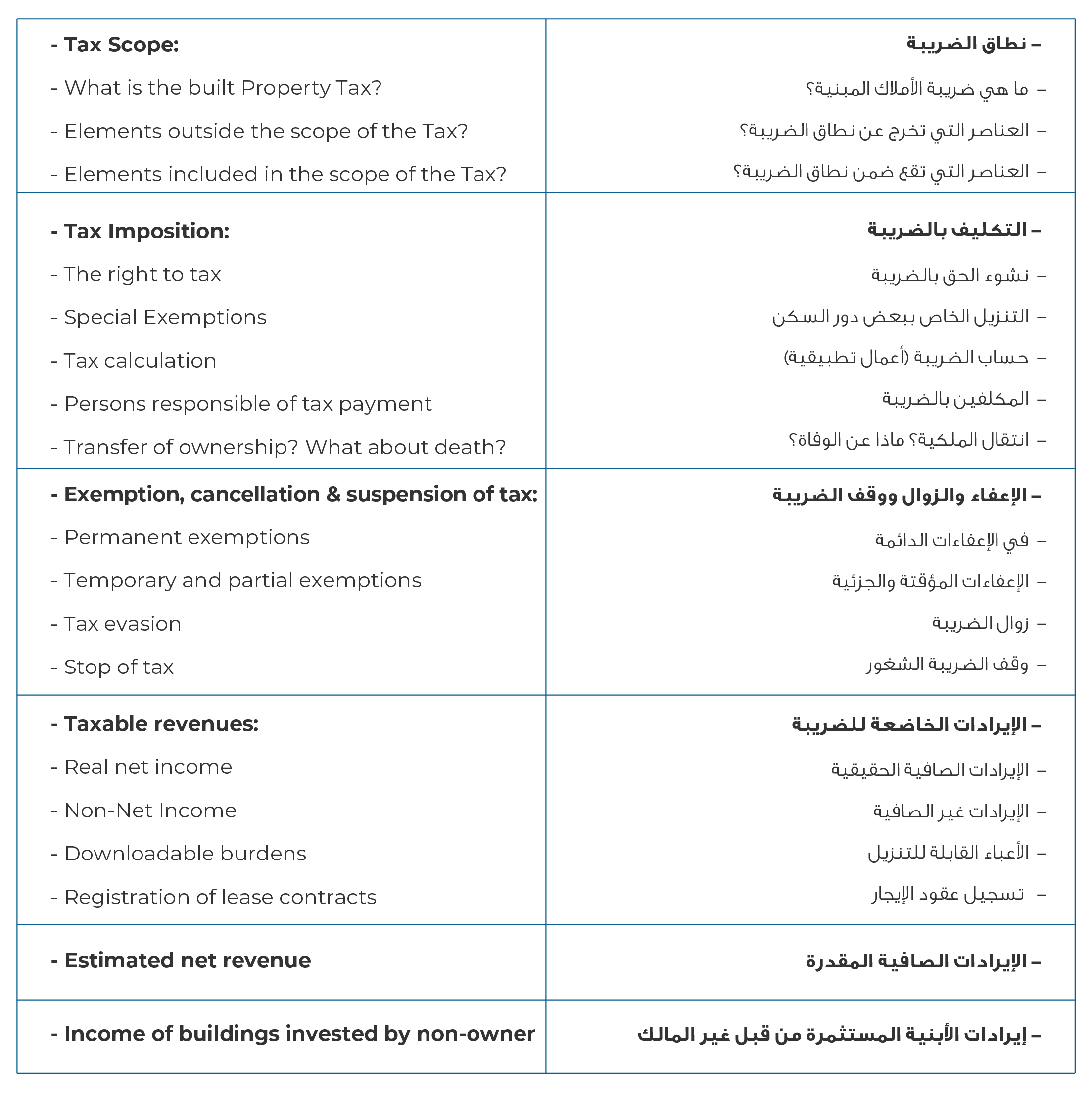

Workshop Outlines